PH BIR 1702Q 2018-2025 free printable template

Show details

Republic of the Philippines

Department of Finance

Bureau of Internal Revenuer BIR

BCS/

Use Only: Item:

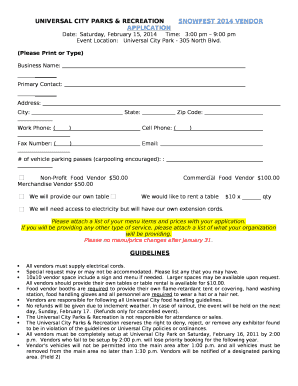

BIR Form No. Quarterly Income Tax Return1702Q

January 2018 (ENDS)

Page 1For Corporations, Partnerships

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bir form 1702q excel download

Edit your 1702q excel format form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bir form 1702q form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bir form 1702 q online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 1702q form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH BIR 1702Q Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 1702q form

How to fill out PH BIR 1702Q

01

Download the PH BIR Form 1702Q from the Bureau of Internal Revenue website or obtain a physical copy from the BIR office.

02

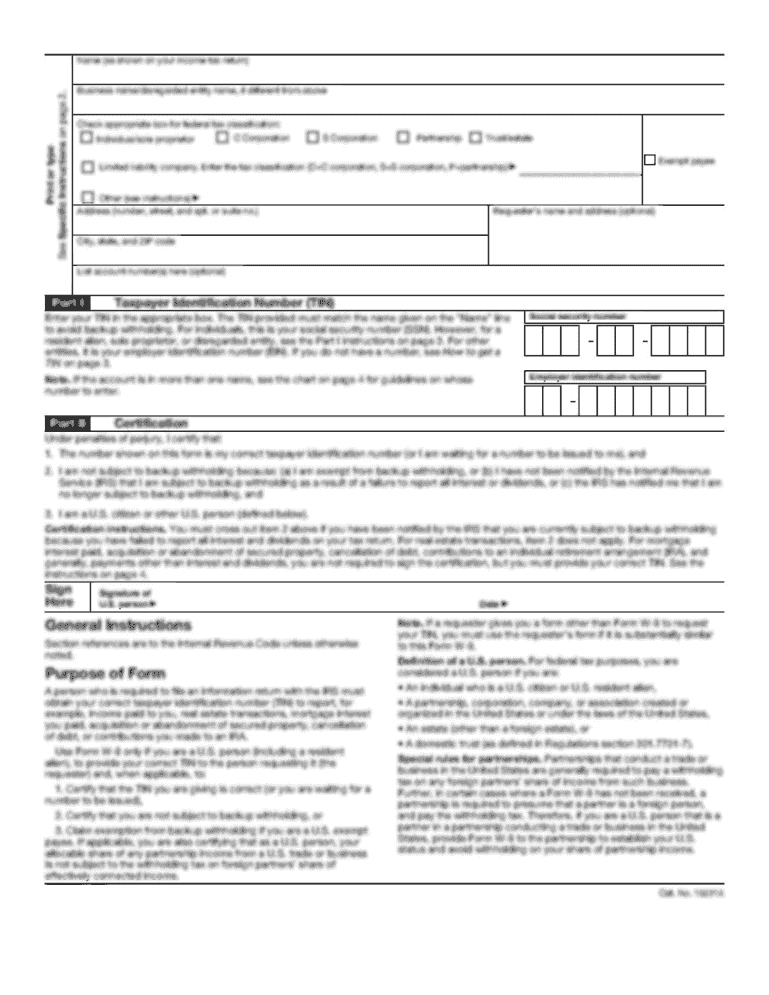

Fill in your Taxpayer Identification Number (TIN) at the top of the form.

03

Provide your complete name, business name (if applicable), and address in the designated sections.

04

Indicate your tax period for which you are filing the form.

05

Complete the income section by reporting your total income received during the tax period.

06

Fill out the allowable deductions based on your business operations and expenses.

07

Compute your taxable income by subtracting total deductions from total income.

08

Calculate the tax due based on the taxable income and applicable tax rates.

09

Include any prepayments or credits that apply to your tax due.

10

Sign and date the form, and submit it either online or at your designated BIR office.

Who needs PH BIR 1702Q?

01

Individuals and corporations engaged in business or practice of profession in the Philippines.

02

Taxpayers with an annual gross income exceeding the threshold set by the BIR.

03

Entities required to file income tax returns on a quarterly basis.

Fill

1702q form download

: Try Risk Free

What is bir form 1702q?

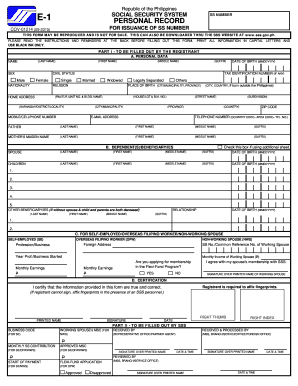

BIR form 1702Q, or also known as Quarterly Income Tax Return (For Corporations and Partnerships) is a tax return intended for corporations, partnerships and non-individual taxpayers.

People Also Ask about form 1702q

What is BIR Form 1702?

BIR form 1702-RT, or also known as Annual Income Tax Return for Corporation, Partnership and Other Non-Individual Taxpayer Subject Only to REGULAR Income Tax Rate is a tax form which is filed by non-individual taxpayers whose earnings are subject to income tax rate of 30%.

What is electronic BIR forms eBIRForms?

The Electronic Bureau of Internal Revenue Forms (eBIRForms) was developed primarily to provide taxpayers with an alternative mode of preparing and filing tax returns that is easier and more convenient.

Who are required to use eBIR forms?

Who is Required to Use eBIRForms? Top Withholding Agents (TWA) Accredited Tax Practitioners on all its client-taxpayer. Accredited Receipt/Invoice Printers. One-Time Transaction Taxpayers (ONETT) on real properties. No Payment or No Transaction Tax Filing. Government Owned or Controlled Corporation (GOCC)

What are the different BIR forms?

Account Information Forms. Application Forms. Certificates. Documentary Stamp Tax Return. Excise Tax Return. Income Tax Return. Legal Forms. Other Forms.

What is BIR Form 1701Q?

BIR Form 1701Q - Quarterly Income Tax Return.

How to fill out EBIR form?

Download and the latest eBIRForms Offline Package. the software and look for the eBIRForms icon on your computer (take note that you can only use. Enter important background details such as your TIN, RDO Code, etc. Then, select the type of BIR form you want to file and click “Fill Up”.

How many forms does BIR have?

The eBIRForms is a package application covering thirty-six (36) BIR Forms comprised of Income Tax Returns; Excise Tax Forms; VAT Forms; Withholding Tax Forms; Documentary Stamp Tax Forms; Percentage Tax Forms; ONETT Forms and Payment Form, the list of which is shown below.

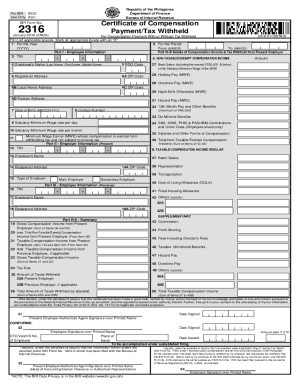

What is the purpose of BIR Form 2307?

The BIR Form 2307 is also known as the Certificate of Credible Tax Withheld at Source. This is used to present the income of an individual or business entity that is subject to Expanded Withholding Tax (EWT) paid by the withholding agent.

What is BIR form for self employed?

BIR Form No. 1701 shall be filed by individuals who are engaged in trade/business or the practice of profession including those with mixed income (i.e., those engaged in the trade/business or profession who are also earning compensation income) in ance with Sec. 51 of the Code, as amended.

How to file 1701 using eBIRForms?

0:56 5:53 So open up the ebir forms. App if it's your first time using the app you'll need to set up yourMoreSo open up the ebir forms. App if it's your first time using the app you'll need to set up your profile. The data needed could be found in the certificate of registration.

How do I access my EBIR form?

How do you file through eBIRForms? Download and the latest eBIRForms Offline Package. the software and look for the eBIRForms icon on your computer (take note that you can only use. Enter important background details such as your TIN, RDO Code, etc.

How do I file taxes with eBIRForms?

How do you file taxes using eBIRForms? After installing, open the software by clicking the icon of the eBIRForms. Fill out the necessary details like your RDO code, TIN, email address, active contact number, registered address, etc. Select what type of BIR form you want to file and click fill up.

How do I declare self employed income in the Philippines?

Important Notes on Freelance Tax Fill out forms before heading to the BIR Office. You can download the forms on the BIR website. Remember to bring your Cash Disbursement and Cash Receipt Journal Books for registration. Photocopy your CoR and Form 005 and take them to the Accredited Printers of Receipts of the BIR.

What is the latest version of eBIRForms 2022?

3.

What is the difference between ITR and 2316?

The ITR is a tax return while BIR Form 2316 is the certification of an employee's income and taxes withheld. However, you can use the two interchangeably.

How do I use eBIRForms 1701?

0:56 5:53 How to File Annual Income Tax Return (1701) Online using eBIR Forms in YouTube Start of suggested clip End of suggested clip So open up the ebir forms. App if it's your first time using the app you'll need to set up yourMoreSo open up the ebir forms. App if it's your first time using the app you'll need to set up your profile. The data needed could be found in the certificate of registration.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 1702q excel without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including bir form no 1702q, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send bir 1702q to be eSigned by others?

When your 1702q ebirforms is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I edit how to edit bir forms online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your 1702q bir and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

What is PH BIR 1702Q?

PH BIR 1702Q is a quarterly income tax return form used in the Philippines for corporations and partnerships to report their income, deductions, and tax liabilities.

Who is required to file PH BIR 1702Q?

Corporations and partnerships engaged in trade or business in the Philippines are required to file PH BIR 1702Q, provided they are not subject to the percentage tax.

How to fill out PH BIR 1702Q?

To fill out PH BIR 1702Q, taxpayers need to complete various sections of the form, including income details, deductions, tax rates, and compute the tax payable based on the reported figures.

What is the purpose of PH BIR 1702Q?

The purpose of PH BIR 1702Q is to provide the Bureau of Internal Revenue (BIR) with a formal declaration of a corporation or partnership's income and tax liability on a quarterly basis.

What information must be reported on PH BIR 1702Q?

PH BIR 1702Q requires reporting of gross income, allowable deductions, net taxable income, past payments or credits, and the resulting tax due for the quarter.

Fill out your PH BIR 1702Q online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bir Form 1702q Download Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to 1702 q

Related to 1702q bir form excel

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.